Resilience was the word Martin Gruenberg, FDIC Chairman, chose to describe the banking industry when first quarter results were released on Wednesday. Gruenberg cautioned on the current interest rate environment, particularly when it comes to commercial real estate, but insisted the industry is well-positioned to weather whatever may come its way.

Resilience was the word Martin Gruenberg, FDIC Chairman, chose to describe the banking industry when first quarter results were released on Wednesday. Gruenberg cautioned on the current interest rate environment, particularly when it comes to commercial real estate, but insisted the industry is well-positioned to weather whatever may come its way.

Resilience was the word Martin Gruenberg, FDIC Chairman, chose to describe the banking industry when first quarter results were released on Wednesday. Gruenberg cautioned on the current interest rate environment, particularly when it comes to commercial real estate, but insisted the industry is well-positioned to weather whatever may come its way.

On balance, Bauer tends to agree, and here are just some of the reasons why:

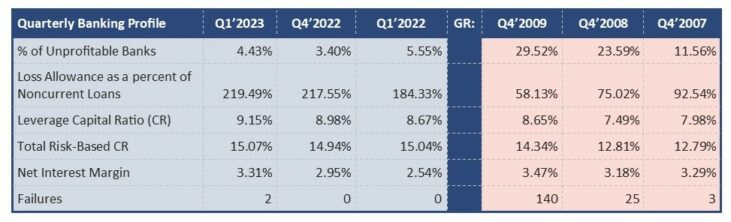

Over 95% of the banking industry is profitable. While that number is down slightly from year-end, it is up from a year ago. As the nation appears to be gearing up for a minor recession, we are also going to compare the first quarter numbers to those we saw during the Great Recession (see chart GR 2007-2009).

Allowances for loan losses are abundant, enough to cover more than twice what was reported as noncurrent at March 31, 2023… and, they continue to climb.

That is a huge contrast to the coverage ratio we watched decline during and after the end of the GR. The actual dates of the GR were December 2007-June 2009. At nineteen months, it was the longest recession the U.S. has endured since WWII. We do not expect a repeat.

At 9.15% and 15.07%, respectively, the industry leverage capital ratio (CR) and Total risk-based CR are both well above where they were at the start of the Great Recession. Already robust, these ratios too, have been trending upward.

Net interest margin (NIM) is where we will likely see the biggest struggle. At 3.31%, first quarter NIM was 77 basis points higher than a year ago and above the prepandemic average of 3.25%. However, if the cost of deposits rise faster than the yields on loans, or if loans begin to go sour, that margin could wane.

The Chart below compares bank industry metrics from first quarter 2023 with year-end 2022, first quarter 2022, and year-ends 2007 through 2009 (the Great Recession years).

Today, just over 1% of the nation’s banks are rated 2-Stars or below and thus relegated to Bauer’s Troubled and Undercapitalized Bank Report. They can be found on page 5 of this week’s Jumbo Rate News as well.

What lands a bank in this position can range from low capital ratios (like Zero-Star Silvergate Bank, LaJolla, CA with a leverage CR of just 3.63%) to nonperforming loans (like 2-Star BancCentral N.A., Alva, OK) which has a Bauer’s Adjusted CR of 3.126% and a Texas Ratio of 100.84%.

Troubles may stem from profitability (or lack thereof) as is the case with 1-Star Grand Rivers Community Bank, Grand Chain, IL, which hasn’t posted a profit in over 5 years. Or, a bank’s downgrade could be the result of a regulatory enforcement action (à la 2-Star Luana Savings Bank, IA).

In fact, there are so many scenarios that could land a bank on that report, it is pretty amazing that it contains so few now. That is a true testament to the current strength of the industry. For three and a half years beginning in the first quarter ’09, more than 10% of U.S. banks were 2-Star and below. In fact, for four quarters, it topped 13%. Thankfully, that is a very long way from where we are today.

Only one new bank was chartered during the first quarter: 3½-Star Adelphi Bank, Columbus, OH opened for business on January 18, 2023. It is just the 18th Black or African-American owned bank in the U.S. and the only one headquartered in Ohio. It is also just one of 22 minority banks that cater to Blacks or African-Americans. Its goal is to remove the barriers to financial equity, thereby improving customer lives. Its tagline is: Banking Without Inherent Bias.

If you ask us, that is how all banking should be, but clearly that is not the case. We commend it for filling a need.

The FDIC approved Adelphi Bank’s application with a condition that it would open with a minimum of $17.670 million in initial paid-in capital and maintain a Tier 1 capital to assets ratio of at least 8% for its first three years.

At the end of March, Adelphi Bank had $22.183 million in capital and a Tier 1 capital to assets ratio of 112.942%. So far so good.

Just for comparison, in the first quarter of 2008 there were 38 new banks. That was down from 41 the previous year. Sadly, this is the world we live in. We need more de novo banks...not just more fintechs.