Today, roughly 650 U.S. banks and credit unions (combined) are designated as Minority Depository Institutions (MDIs). Yet, a snapshot of mortgage loan data for 2023 shows there is still a wide gap in approval rates by race/ethnicity.

In this week's issue of Jumbo Rate News, we provide a list of 50 MDIs with high amounts of single family (1-4) residential real estate loans on their books. The vast majority are recommended by Bauer (i.e. rated 5-Stars or 4-Stars).

We also provide links to the FDIC and the NCUA where you can find lists of all MDIs, banks and credit unions, respectively.

Back to Your Community; Back to Neighbors & Friends

Earlier this month (7/11/24), the Federal Financial Institutions Examination Council (FFIEC) published its findings on 2023 mortgage lending. This data is used to assess potential threats to fair lending as well ascertain how well local needs are being met by the financial institutions in the area.

A snapshot of the data included information on 10 million home loan applications (down from 14.3 million in 2022). The share of first lien, single-family (1-4) owner-occupied mortgages originated by non-depository mortgage companies, increased from 60.2% in 2022 to 68.8% in 2023. Those made by race and ethnicity changed as follow:

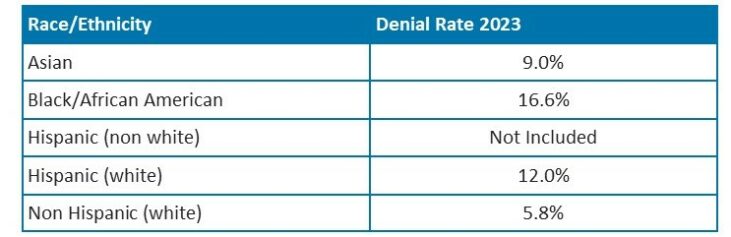

The denial rates by ethnicity were:

No numbers were provided for Native Americans in this snapshot. But notice at the huge approval gaps between the groups that are there.

This is one reason Minority Depository Institutions (MDIs) are so important. While fair lending across all lenders is imperative, our focus at Bauer is (and has always been) depository institutions: banks and credit unions. Today, roughly 650 U.S. banks and credit unions (combined) are designated as MDIs.

As of March 31, 2024, these MDIs had total assets of $441.2 billion. Of those assets, $300 billion was in the form of loans. Approximately $86 billion of those loans are for single (1-4) family residential real estate.

Fifty of these MDIs can be found on page 5. Each has more than $180 million in residential real estate loans outstanding as of March 31, 2024. (For purposes of this list, we eliminated Hawaii (9) and Puerto Rico (3).) However, complete lists can be found via the following links:

Complete List of Credit Union MDIs

We will examine several, beginning with a Native American MDI, 4-Star Gateway First Bank, Jenks, OK. Gateway offers “high-touch” communication to guide customers through the mortgage process. It is proud to invest back into its communities. That is, after all, where the bank’s own employees have their homes, lives and families. Gateway First Bank has 17 branch offices in six states to accommodate its customers. It is currently offering a 7 month CD at 5.15% APY (although, that CD is only available in 38 states).

Next up: Asian American. Established in 1986 as California Central Bank, 5-Star Bank of Hope, Los Angeles, CA has been through many changes in four decades, including: six acquisitions; three name changes; and a move. It has grown it into “The Only Super Regional Korean American Bank in the U.S.”

While Bank of Hope offers banking services to Korean Americans in 24 states (from Massachusetts to Hawaii), only about 7.5% of its loans are for single-family residences.

As a preferred Small Business Administration (SBA) lender, the vast majority (over 60%) of Bank of Hope’s loans are for Commercial Real Estate (CRE) and over 24% are Commercial & Industrial (C&I) loans. But, with $18 billion in assets, it’s a pretty big bank with a lot of loans, over $1 billion of which ARE invested in residential real estate.

At 0.87% of total loans, Bank of Hope’s delinquent loans are in-line with other banks of similar size. And, to its credit and because it works with its borrowers, Bank of Hope currently has no repossessed assets.

Now let’s direct our attention to 5-Star Municipal Employees C.U., Baltimore, MD (also known as MECU, pronounced “Me-Q”), a Black or African American MDI.

MECU was established during the height of the great depression in 1936. Over the years, it too has acquired several institutions, including a bank in 2014. What began as a simple way for Baltimore municipal employees to make the most of the little money they had, has now turned into a nearly $1.3 billion community credit union with over 103,000 members. Just over 25% of MECUs loans (roughly $281 million worth) are first mortgage real estate loans.

5-Star Rally Credit Union, Corpus Christi, TX, a Hispanic MDI was originally established in 1955 as Navy-Army Federal Employees CU. It has morphed over the years and became Rally Credit Union in February 2023, a community CU serving eight Texas counties.

Like many MDIs, Rally CU has a fairly robust financial literacy program. Many under-estimate the travails of navigating the journey toward homeownership as a member of a minority group. MDIs have their fingers on the pulse of the community and the knowledge to lead their members/customers through the often arduous and painstaking process. Some Big Banks (like 4-Star Bank of America, 4-Star Citibank and 3½–Star State Street B&T) have begun to understand this as well and are now collaborating with MDIs to boost their lending power. Its no panacea, but it is a start.