It was hanging on by a thread, for a very long time. According to the FDIC press release, Zero-Star First City Bank of Florida's difficulties began in 2009, but we added it to Bauer's Troubled and Problematic Bank Report based on fourth quarter 2008 financial data. Either way, it was pre-pandemic.

Over the years, the bank's losses kept accumulating and its troubled loans kept growing. Yet somehow, it managed to stay above the "Critically Undercapitalized" level (albeit barely) until June 30, 2020. At the close of the second calendar quarter of this year First City Bank of Florida's leverage capital ratio finally dropped below 2% and that was it. Regulators had no choice but to find an acquirer or shut it down.

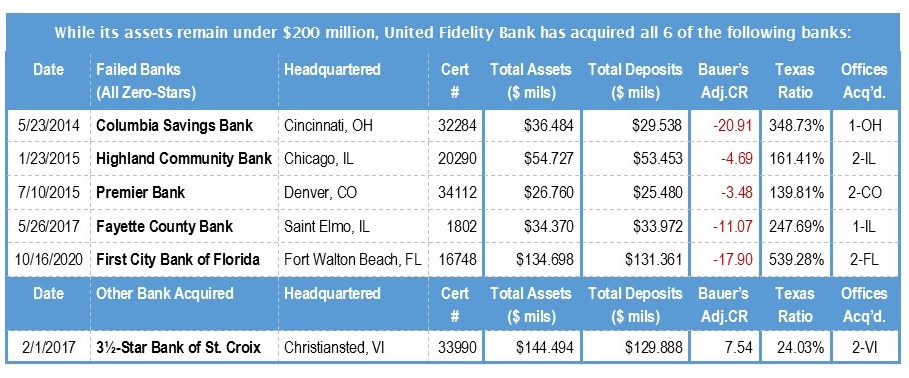

Longtime JRN listee 3½-Star United Fidelity Bank, FSB, Evansville, IN stepped up to the plate, as it has done several times in the past (page 2), to take over the deposits and assets of the troubled Florida bank.

Zero-Star Almena State Bank, KS is the only other bank categorized as "Critically Undercapitalized" as of June 30th. Like First City Bank, it has been experiencing devastating losses and dismal loan performance. But its capital loss was much more precipitous. Almena State Bank has been rated Zero-Stars by Bauer for the past six quarters, but according to regulators, it wasn't until the second quarter 2020 that it became "Critical". A negative Bauer's Adjusted Capital Ratio for the past 5 quarters told us otherwise. (Almena State Bank was closed on Friday, October 23, 2020, after this article went to press.)

While these are the only two that are "critically undercapitalized" by regulatory standards, there are 45 other banks that we see in a similar situation. In addition to a sub-par star-rating (2-stars or below), each bank listed on page 7 is struggling in at least one of the following loan quality measures:

- Allowance for loan losses is less than 70% of delinquent loans;

- Nonperforming Assets are 1.5% or more or Tangible Assets;

- Bauer's Adjusted Capital Ratio is 5% or less; and/or

- Texas Ratio is 50% or greater.

Many of the banks will be familiar from recent articles addressing specific types of loans, but this week's list looks at the entire loan portfolio. The two referred to above that are "Critically Undercapitalized" are noted in bold.

Of course, all 47 (and more) can be found on Bauer's Troubled and Problematic Bank Report, but these are of particular concern as they brace themselves for a potential onslaught of defaults. Those with a negative Bauer's Adjusted Capital Ratio and/or a Texas Ratio approaching or exceeding 100% cannot afford any missteps, but you can be sure we will be watching them all...very carefully. (And yes, the two banks that failed earlier this year both had a negative Bauer's Adjusted Capital Ratio when they went under.)

United Fidelity Bank has an interesting backstory of its own. When it changed its name from Evansville Federal back in 1995, we suspected it was thinking of spreading its wings, but it bided its time. It wasn't until the FDIC was looking for someone to take over Columbia SB in neighboring Ohio that the bank decided to bite. That Ohio branch is long gone, but United Fidelity continues acquiring small banks (about one a year). Today it operates through 19 offices in CO (2), FL(3), IL(3), IN(9) & the Virgin Islands (2).