If anything has been made clear over the past couple of weeks, it is that no place is protected from the wrath of Mother Nature.

Beyond a devastating human toll, weather-related events also take a huge financial toll. This is particularly bad news for banks that are already struggling with loan quality.

In this week's issue of Jumbo Rate News we list 50 banks that are showing signs of stress in commercial loan portfolios, whether it be C&I, CRE and/or multi-family residential buildings. They hale from all corners of the country.

Can’t Bank on Mother Nature

We have all seen the devastation wrought by Hurricane Helene in the Southeastern States. Our thoughts and prayers go out to all of those who have been touched by the storm and ensuing floods.

We believe it is safe to say that no one expected this type of hurricane damage so far inland. It is therefore unlikely that many of the homes and businesses had flood insurance. The SE is not the only vulnerable area.

According to the Federal Reserve Bank of New York, nearly one million houses and multi-family residential buildings in the tri-state area of CT-NJ-NY are also at risk of flooding. Forty percent of them are in low or moderate income areas.

In the New York area, the problem has been identified, which is a huge step in finding a solution. That was not the case in the Smokey Mountains yet, vulnerabilities can be found in every state. Beyond the devastating human toll, these events also take a huge financial toll.

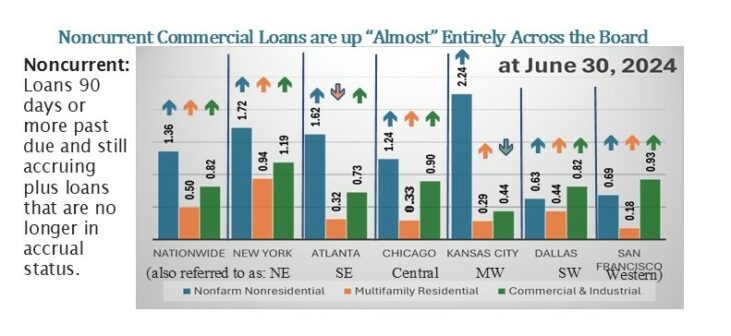

This week we will look at banks that have already been struggling with commercial loan quality. During the 12 months ended June 30, 2024, commercial loans at banks across the country have been deteriorating. We examine three segments:

1) Nonfarm nonresidential property (i.e. businesses and shopping malls) saw a 54 basis point (bp) increase in nonperformers nationwide with the Kansas City region reporting the highest at 2.24%;

2) Multifamily (5 or more) residential property nonperforming loans increased 29 bps from 0.21% to 0.50% nationwide, with the New York region reporting the highest at 0.94%; and

3) Commercial & Industrial (C&I) loans posted the smallest increase (14 bps). The NY region once again has the highest rate at 1.19%.

Just as every region has its own unique battles with Mother Nature, each also has struggling banks.

The 50 banks listed on page 5 are all showing signs of stress in commercial loan portfolios, whether it be C&I, CRE and/or multi-family residential buildings. In addition to having a Bauer rating of less than 4-Stars, each reports that commercial loans represent at least 45% of total loans and either delinquent commercial loans are 3% or higher than total commercial loans and/or the total delinquency to loan ratio is at least 3%.

One bank from the Dallas region, that we have reported on before, continues to warrant a spot on this list: 1-Star BancCentral N.A., Alva, OK. We wish we could report that it is improving, but we cannot. At June 30, 2023, BancCentral had total assets of $336.5 million, tier 1 capital of $34.7 million and a leverage capital ratio (CR) of 9.59%. In one year it lost 17.1% of its assets and 25.6% of its equity so its leverage CR is down to 8.64%. And that’s just the beginning. Last year BancCentral had a Texas Ratio of 91.9% and a Bauer’s Adjusted CR of 2.99%. Today those ratios are 136.1% and –2.7%, respectively. Loans at BancCentral decreased by a third this year and 25% a year earlier, yet commercial loans still account for over 63% of its loan portfolio. What’s more, BancCentral has not posted a profit since the third quarter of 2022. Fortunately, there are thousands of strong community banks to choose from.

Six Big Banks also each have over $100 billion in exposure to these three types of loans (below). BofA has, by far, the most C&I loans outstanding ($272.7 billion). Wells Fargo tops CRE ($85.1 billion) and JPMorgan is well above the rest in multi-family ($102 billion). No other banks come even remotely close.

To help people affected by Hurricane Helene, visit www.redcross.org/donate/dr/hurricane-helene.html/.

| Bank Name | City | ST |

Star Rating |

Total Assets ($ mils) | Total Loans ($ mils) | Domestic CRE, C&I, and Multi-Family ($ mils) | Leverage CR | Bauer’s Adjusted CR |

Q2 Net Income ($ mils) |

| Bank of America N.A. | Charlotte | NC | 4-Stars |

$2,550,584.000 |

$1,054,531.000 | $337,598.000 | 7.63% | 7.34% |

$6,807.000 |

| JPMorgan Chase Bk NA | Columbus | OH | 4-Stars |

$3,510,536.000 |

$1,333,973.000 | $327,893.000 | 8.13% | 7.86% | $16,678.000 |

| Wells Fargo Bank N.A. | Sioux Falls | SD | 4-Stars |

$1,719,839.000 |

$886,400.000 | $282,866.000 | 8.68% | 8.16% |

$5,691.000 |

| PNC Bank N.A. | Wilmington | DE | 4-Stars |

$552,530.492 |

$322,436.964 | $164,744.545 | 8.71% | 8.17% |

$1,540.892 |

| U.S. Bank N.A. | Cincinnati | OH | 5-Stars |

$664,923.875 |

$378,714.951 | $136,138.803 | 9.20% | 8.85% |

$1,615.721 |

| Truist Bank | Charlotte | NC | 4-Stars |

$511,931.000 |

$307,054.000 | $119,516.000 | 10.31% | 10.02% | $991.000 |