In the current environment of high unemployment and moratoriums on foreclosures and evictions, we will be delving deeply into the aspects of Commercial Real Estate (CRE). CRE loans are comprised of multifamily (five or more) residential real estate, office buildings, shopping malls and most other structures that house businesses.

This week we are going to concentrate on the largest subcategory of CRE, non-farm, non-residential real estate, which was up 5.3% at the nation’s banks during the 12 months ending March 31, 2020 and now exceeds $1.5 trillion. (We will look more at the 5+ family residential properties next week.)

There are currently 48 community banks with more than 49% of their loan portfolio invested in nonfarm nonresidential CRE loans AND also report at least 1.4% of those CRE loans delinquent 90 days or more. They are listed on page 7.

You may wonder, if we say we need to watch these banks, how can so many of them be rated 5-Stars, or even 4-Stars. It’s really quite simple. While we rigorously dissect the Call Report, Bauer’s star-rating system is holistic. Every 5-Star bank on page 7 excels in other endeavors.

Our analysts also compare incoming information against historical data. While we acknowledge that capital is king, there is much more to look at. That’s why this week, instead of showing how we have 5-Star banks on page 7, we are going to show how an uber-capitalized bank (California Pacific Bank) can be rated just 3-stars.

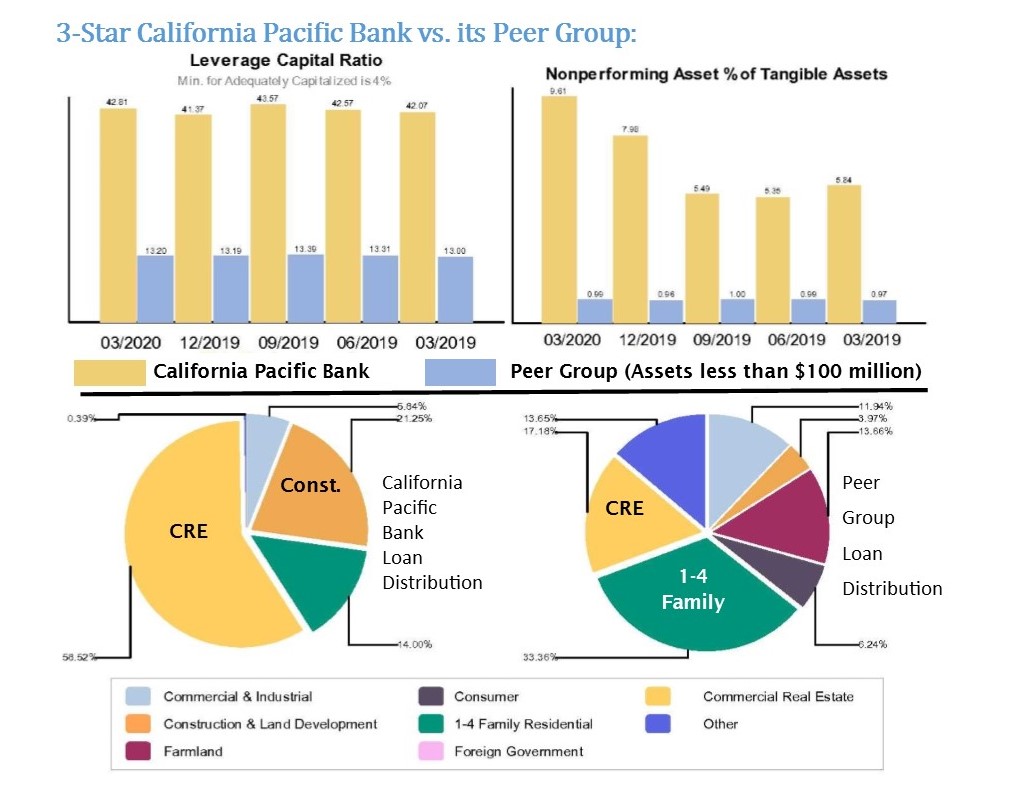

Established in 1980, California Pacific Bank currently has a leverage capital ratio of almost 43%. That’s what we call uber-capitalized. It dwarfs the 13.2% of its peer group (see page 2). However, 58½ of its loans are in one the most risky sectors, even in the best of times: CRE. Another 21% is in construction loans, which isn’t much better. That’s 80% of its loan portfolio.

With little else to lean on, a 10.2% CRE delinquency rate puts California Pacific Bank’s overall delinquency rate at a whopping 9.6%. We’d like to see it diversify its loan portfolio in the coming quarters.

These Charts are included on Bauer’s LLAMAS Report, available on any U.S. bank or C.U.