Bank payrolls reported unprecedented increases beginning in the fourth quarter of 2021. Today, we take a look at the forces behind the shedding of many of those newfound banking jobs.

The 53 banks listed on page 5 of this week’s Jumbo Rate News each lost 15% or more of their staff (full-time equivalent (FTE) employees) during the first six months of 2023.

Irrational Exuberance Comes in Many Forms

Interest rates were low, real estate lending was popping, and crypto was the new hot commodity. Those are just three of the factors that led to unprecedented increases in bank payrolls beginning in the fourth quarter of 2021.

Today, it’s a different story. Interest rates are now at their highest level in 16 years, our appetite for loans has diminished and crypto is, well??

Three regional bank failures were caused, at least in part, by irrational exuberance over digital assets and fintech ties. What we find now is a banking industry in need of trimming excess staff, in their lending departments and elsewhere.

We will see more of this as the year progresses, but the process has already begun. The 53 banks listed on page 5 of this week’s JRN each lost 15% or more of their staff (full-time equivalent (FTE) employees) during the first six months of 2023.

To make the chart more meaningful, we limited it to banks that ended calendar ’22 with more than 12 employees. You’ll notice the financial data on page 5 is as of June 30, 2023 but the star-ratings are missing. We are still working on those and will have new star ratings for you next week.

Two banks are conspicuously missing from the page 5 list: 5-Star Goldman Sachs Bank USA, New York NY, which has announced plans to shed more than 3,000 jobs and 4-Star Bank of America, N.A., Charlotte, NC, which similarly issued pink slips to 1,000 employees earlier this year. These job cuts will bring the banks back to approximately year-end 2019 and year-end 2021, respectively.

Two banks that are listed on page 5 have been ordered by their regulator to wind themselves down. Both Zero-Star Silvergate Bank, LaJolla, CA and 2-Star Farmington State Bank, Farmington, WA got caught up with the failed crypto giant, FTX.

We have reported on Silvergate Bank before, but Farmington, the small, Washington community bank, once a revered community mainstay, deserves further edification.

For a century Farmington State Bank served the quiet farming community of Farmington, WA. Then, in 2020, the bank was sold to a Bahamian banker, Jean Chalopin, who also owns a Bahamian bank that specializes in crypto.

In 2022, without going through the required channels, Chalopin took an $11.5 million investment from an FTX affiliate for his U.S. bank. That investment doubled Farmington’s net worth, but only for a short time. Within a year, prosecutors seized $50 million alleging that the funds came from FTX fraud. Sadly, no other bank operates in the small town of Farmington.

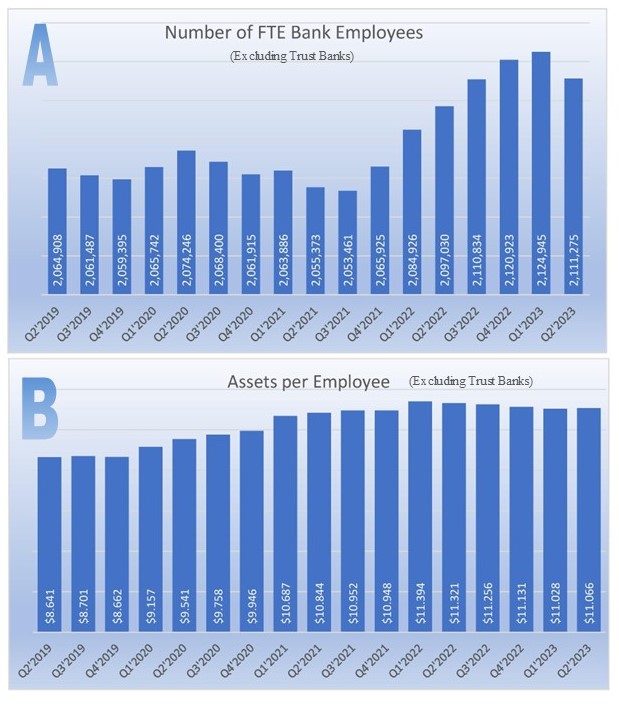

Charts A & B can be described as two chapters of the same story. In Chapter 1 (Chart A) we see that after a brief period of job contraction during quarters 2 and 3 of 2021, U.S. banks began hiring in earnest.

By the first quarter 2023, bank payrolls were pretty bloated. That may have been alright had loan demand kept up. The Fed’s relentless rate increases, however, have squelched loan demand and put many of those newfound banking jobs in jeopardy.

Chart B shows that during the first and second quarters of 2022, bank employees were working particularly hard, with more than $11.3 million in assets per employee. That’s more than an incremental jump from $8.6/$8.7 million per employee that we saw in 2019. We do expect to land somewhere in between those figures before its done.