Between 9/30/22 and 9/30/23, loans 90 days or more past due increased 17.6%. Short-term (30-89 days) past dues increased 9%. We are very curious to see what year-end data looks like as we are already seeing signs of deterioration with third quarter data.

Bankers see problem loans rising as well, as evidenced by a 33% increase (on average) in loan loss provisions from September 30, 2022 to September 30, 2023.

A list of 50 banks with two or more indicators of troubles in their loan portfolio can be found on page 5 of this week's issue of Jumbo Rate News.

Loan Quality: Fair But Partly Cloudy

When we last updated star ratings (JRN 40:46), we reported that loans 90 days or more past due increased by just 7 basis points during the third quarter, but between 9/30/22 and 9/30/23, they increased 17.6%. Additionally, short-term past dues (30-89 days) increased 9%.

On average, banks also reported a 33% increase in provision expense over the year. Banks in the Western (or San Francisco) Region averaged more than two and a half times the loss provisions than the rest of the country (84 basis points vs. 33 bps). Perhaps that’s why only three of the banks listed on page 5 are from that Region (two in CA and one in MT).

To create that list, in addition to having a Bauer’s star rating of less than 4-Stars, each bank has either:

- a Bauer’s adjusted capital ratio (CR) of less than 3%; or

- nonperforming assets exceeding 2.5% of tangible assets AND sufficient loan loss allowances to cover less than 80% of their delinquent loans.

2-Star Monterey County Bank, CA, has all three. A fixture on Bauer’s Troubled and Problematic Bank Report since 2010, Monterey County Bank is no stranger to this list and in the first nine-months of 2023, things devolved further. Its Bauer’s adjusted CR dropped to under 2%, total loans dropped by 10.5% and its Tier 1 Capital dropped by 11%. The bank has now failed to meet its prescribed (9%) minimum leverage CR for two consecutive quarters.

Monterey County Bank was one of just four banks that reported a Bauer’s Adjusted CR of less than 3% at Sept. 30th. Another, Zero-Star Citizens Bank, Sac City, IA, with a Bauer’s Adjusted CR of –6.6% failed on Nov. 3rd (JRN 40:46).

The other two are 2-Star First & Peoples Bank & Trust, Russell, KY and 3-Star Carter Bank & Trust, Martinsville, VA (40:35, 40:41). Both made their first appearance on this list last quarter, but that is where their similarities end.

Back in 1932, First & Peoples Bank was created by the merger of First National Bank of Russell and Peoples Bank of Russell. At that time, it had 7 employees and $626 thousand in assets. As the surrounding community began to grow, so did this new bank—slowly and steadily.

After 90 years of continued growth and service to its community, First & Peoples ended 2022 with over $250 million in assets and 50 employees. It also added a Trust Department where it handles estate planning as well as custodial and managed IRAs and other investments.

Perhaps its biggest shift, however, came in its loan portfolio. During 2022, First & Peoples made a major shift in its lending. Its portfolio, once consisting of nearly 60% pristine consumer loans, was now loaded up with nearly 60% of loans to nondepository financial institutions. Less than 5% of total loans are now loans to consumers.

That represented a major shift and apparently one the bank was not prepared for. Delinquent loans rose from $1.25 million to over $20 million in one quarter. Delinquencies as a percent of assets, less than 0.5% at March 31, 2023 are now over 8%.

First & Peoples had already charged off $8.654 million of bad loans through September 30th, but those charge-offs are eating away at its net worth. In six months, First & Peoples witnessed a 14.6% decline in assets and a 68% drop in net worth. It has been a very expensive lesson for the bank.

Community banks should stick to what they do best and that’s taking care of their communities. Carter Bank & Trust, on the other hand, is not really a community bank. With over $4.4 billion in assets and branches spanning Virginia and North Carolina, it does not meet the FDIC definition of a “community bank”, although it does think of itself as one.

Carter B&T is celebrating 50 years of service this year and will have different events throughout the year to mark the occasion. But it hasn’t actually been Carter Bank for 50 years. We believe that is another area that’s open for interpretation. It isn’t wrong, but the official start date for Carter B&T is much later.

Carter B&T was actually the result of a combination of ten local area banks. This combination took place at the close of calendar 2006 (17 years ago). While that is the “official” established date, those ten banks were well established, themselves. One, FNB of Rocky Mount, VA, was established in 1974 and that’s how it can claim a 50 year history.

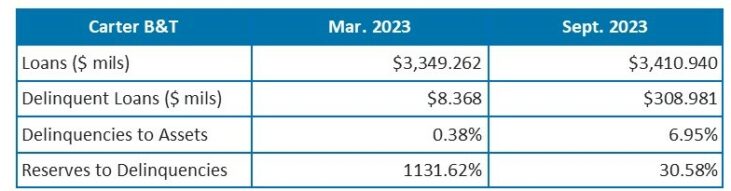

As for its loan portfolio, Carter Bank has more than half (53%) in Commercial Real Estate (CRE). And, in spite of all the headaches CRE has been causing, Carter’s loans were performing quite well, through March anyway. That changed in the second quarter (2023) when Carter’s delinquent loans skyrocketed from $8.4 million to $310.7 million.

Since the Federal Reserve began raising interest rates, many banks have had a hard time making new loans. That has not been a problem for Carter, but perhaps it should have been. The following chart illustrates the deterioration in just a six month period.