It doesn’t matter if you are talking about residential or commercial, ask any realtor what the three most important aspects of real estate are, and the answer will surely be, “location, location, location”. Today, we are going to be looking at commercial real estate in general, but more specifically, office space.

While other subcategories of commercial real estate (CRE) loans (which include retail, hospitality, industrial and multifamily) are holding up quite well, loans for office space have been suffering since the pandemic sent many of us to work from home. And, while a good number of us are back at the office, there are many that have no intention of ever returning.

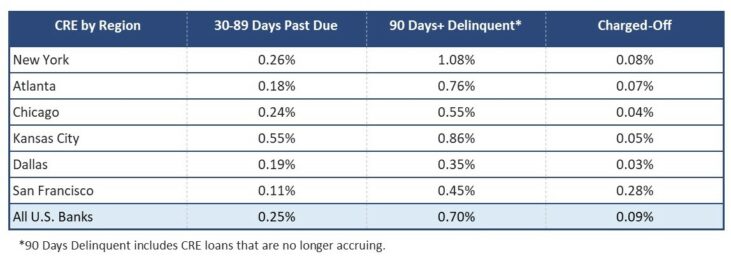

As a result, noncurrent CRE loans are beginning to creep up. Just how much they are creeping depends on your location. First let’s look at the numbers objectively, from the Quarterly Banking Profile.

Between March 31, 2022 and March 31, 2023, our nation’s banks increased CRE lending by 6.5% (from $1.67 trillion to $1.78 trillion). During that time, short term (30-89 days) past due CRE increased just slightly, from 0.24% to 0.25%. CRE loans noncurrent 90 days or longer, increased a bit more (by 4 basis points) from 0.66% to 0.70%. No alarms there. However, CRE loans that were charged-off in the first quarters increased from 0.01% last March to 0.09% this March.

Now we get to the location part. It’s quite interesting:

- In California, for example, a CRE loan is five-times less likely to go into short-term (30-89 days) past due than one in Kansas.

- A New York bank is more than three-times likely to see a CRE loan go into serious delinquency (90 days or more) than a bank in Texas.

- And, banks in the San Francisco Region (AK, AZ, CA, HI, ID, MT, NV, OR, UT, WA, WY and the Pacific Islands) have a higher percent of charged-off CREs than all other regions combined.

That seems crazy, but the numbers don’t lie. These figures are as of March 31, 2023 and come from the FDIC’s Quarterly Banking Profile, reported as nonfarm nonresidential:

Now we want to take a more subjective look. Eight times a year, the Federal Reserve publishes its Beige Book, a synopsis of sentiment across the country based on data collected from informal surveys. There have been four Beige Books published so far this year and we have noticed a couple of running themes that pertain to CRE. They are:

1) Higher interest rates and economic uncertainty are taking their toll on sales;

2) Financing for CRE is becoming more difficult to attain (i.e. tighter standards);

3) Demand for office space is weak, leading to higher vacancy rates;

4) Subleasing is becoming more popular as is the practice of tenants demanding (and landlords offering) incentives and concessions; and

5) New construction is limited. Especially in the office sector.

The 50 banks listed on page 5 of this week’s Jumbo Rate News are on a special CRE watch list with Bauer. Based on March 31, 2023 financial data, in addition to being rated less than 5-Stars, in each instance, CRE loans account for over 20% of the entire loan portfolio. Of those CRE loans, at least 1.5% are 90 days or more delinquent, and the percent of delinquent CRE has grown 10% or more from March of last year.

Out of the 50 banks listed, 13 are headquartered in Illinois. (The Federal Reserve has the nation broken down into 12 districts, so this is not an apples to apples comparison to the FDIC with its six regions, but Chicago is Chicago, in either case.)

In January’s report, at least one Chicago respondent felt there were enough CRE activity to keep new projects flowing for another 6-12 months. But, by May’s Beige Book, school and warehouse construction were the only bright spots as higher interest rates put a damper on the rest of CRE activity.

Contacts in the Chicago Region reported that some projects were postponed or cancelled altogether due to those higher interest rates. Even with construction costs falling, the cost of financing is just too high. In parts of the region, the dearth of new construction is causing retail rents to rise as well.

Retail, industrial, hospitality and warehouses are still pulling their weight, though, even as office space sputters. You will find that the majority of the banks listed on page 5 have diverse loan portfolios. While their CRE may not be performing as well as it could, the loan portfolio as a whole is in good shape. In fact, two-thirds are rated 4-Stars by Bauer.