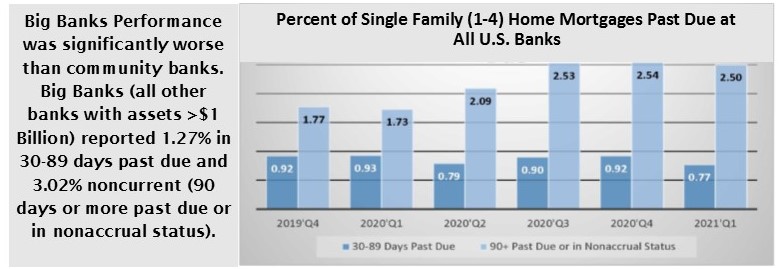

A recent report by the Office of the Comptroller of the Currency (OCC) grabbed our attention with this headline. Then we realized, it was comparing mortgage performance to a year ago (Q1’20 i.e. pre-pandemic). While we did see a spike in nonperforming 1st mortgages last year, nonperformers actually declined a little bit during the first quarter 2021 (see chart).

Also, according to the OCC report:

- The percentage of seriously delinquent mortgages (60 days or more past due + any held by bankrupt borrowers that are 30 days or more past due) went from 1.4% at Q1’2020 up to 5.2% at the end of 2020 and is now 4.6%.

- But, 833 new foreclosures were initiated in the first quarter 2021. That was up 5.6% from the previous quarter and down 95.8% from a year earlier.

- And, 47,773 mortgages were modified in the first quarter of 2021, up 16.4% from the previous quarter. Of those, 55.3% reduced the borrowers’ monthly payments; 57.6% were “multiple modifications” which means most likely a term extension in addition to a reduced interest rate. Over 1/5th of the modified loans were in California, which had 10,285, or 21.5% of the total.

What we find most disturbing, though, is the number of re-defaults for loans that were modified six months prior. There were 1,596 of these re-defaults in the first quarter. The states reporting the most were: Texas (154); California (134); and Florida (118).

Fortunately, beefed up reserves and higher capital levels have kept loan losses from making much of a dent in individual banks... as of first quarter numbers anyway. Its nice to see the Great Recession a decade ago had some positive impact. Bankers and regulators were much better prepared for this storm.

At March 31, 2021, 669 U.S. banks had more than 50% of their total loan portfolio invested in the “safety” of home loans. Fifty-two of them also reported that more than 2.75% of those home loans are 90 days or more delinquent. Those 52 banks are listed on page 7. Contrary to expectations, this actually marks an improvement over last year. At March 31, 2020, the corresponding numbers were 733 banks with more than 50% of loans in mortgages with 61 of them reporting more than 2.75% of them delinquent (JRN 37:32). Interestingly, none of the banks that fall into this category are headquartered in California.

We included Bauer’s Adjusted Capital Ratio next to the leverage ratio on the list to illustrate that, at least in most cases, loan quality overall is holding up quite well even where single family home loans are faltering. In fact, only three of the 52 banks on page 7 are on Bauer’s Troubled and Problematic Bank Report.

The first, a small community bank out of New Orleans, 2-Star Bank of Louisiana has 64.7% of its loans in single family residences. That’s nearly twice that of its peers. While it only reported $2.379 million in delinquent 1-4 family home, that represents 8.76% of the total. Even worse, its nonperforming assets to total assets ratio is 6.1% and delinquent loans to total loans are 6.5%. Its Bauer’s Adjusted capital ratio of 1.99% is a huge improvement over the –3.8% it reported a year ago.

The next is single branch 1-Star Columbia S&LA, Milwaukee. This institutions has been watching its assets climb and its capital drop resulting in a leverage capital of 8.81% March 31, 2020 that dropped to 7.11 at March 31, 2021. Its repossessed real estate represents 32.74% of net worth and its Texas ratio is almost 66%.

And the third is Zero-Star Towanda State Bank, KS. Towanda’s delinquent loans to total loans ratio is 7.5%. It has over 80% of its loan portfolio in single family homes, but those are not the only loans giving Towanda trouble. Its Bauer’s adjusted CR is –3.27% and its Texas Ratio is 116.6%. In fact, Towanda is one of just four U.S. banks that currently has a negative Bauer’s adjusted CR and a Texas ratio exceeded 100%.