In observance of the Easter Holiday, Jumbo Rate News will not be published next week, April 5th. While we are on hiatus though, a new brokered deposit rule will go into effect (April 1st, to be exact). While we don’t see the need to go through a broker when you can place your deposits directly yourself, we also realize that many people prefer to go through an intermediary who, hopefully is looking out for the best interest of their client.

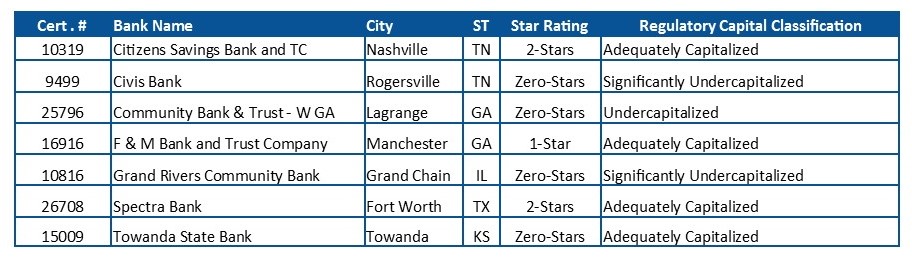

So, what’s changing with the new guidance? For most banks, nothing. All banks that have a regulatory capital classification of “Well Capitalized” may continue to accept brokered deposits without restrictions. That leaves just seven banks, at the moment, that are subject to the new rules. They are:

Only two of them (the two 2-Star rated banks) reported brokered deposits at the end of 2020. So why are they making a big deal about a change that affects so few institutions? There are three reasons we can think of (although regulators will not likely admit to the first).

1. They may be preparing for more banks to fall below the “Well Capitalized” threshold. If that happens, the new procedures will keep banks from using brokers to bring in emergency, high-cost deposits. This was a big problem in the 1980s when savings and loans (S&Ls) so desperately needed liquidity they paid inordinately high interest. Brokers brought their clients onboard and everyone was happy. Until one by one, those S&Ls started to fail.

Brokers have changed a lot since the 1980s and so has the market. But regulators want to make sure they avoid a repeat.

2. The term “broker” has been redefined in this new rule. Simply put, the new rule says that any person in the business of placing third-party deposits at more than one bank or a person who has the authority to close an account for a third party and move deposits on their behalf to another bank, is a broker.

This eliminates several areas of confusion. For example, a broker who works for one bank and only takes deposits on behalf of that bank, is not a broker by this definition. The person is simply a bank employee. And listing services that provide information but have no authority to open, close or move accounts are not brokers, simply information providers.

And, just for the record, BauerFinancial, Jumbo Rate News included, is not a broker and never has been. Bauer does not place deposits. Nor does it open or close accounts. What Bauer does through its rate listings is provide a selection of strong banks that you can choose from to place your own deposits.

3. And finally, the new rule introduced new interest rate caps for “Adequately Capitalized” banks. (Banks with a rating less than Adequate are not allowed to take brokered deposits at all, whereas Adequately Capitalized may do so with a waiver.)

For CDs, there are two possible Caps:

The National Rate Cap, which the FDIC will calculate and publish monthly, is based on a nationwide weighted average for all banks and credit unions offering a specific term plus 75 basis points (or 120% of the current treasury of the same term).

There is also a Local Rate Cap, which is 90% of the highest advertised rate by a bank or credit union with a branch operating in the bank’s same local market area.

The most important change though, is that banks can no longer offer odd terms CDs with higher rates. Any term for which there is no “published” Cap must conform to the next lowest published term. In the past, an Adequately Capitalized bank could offer a 13-month CD at essentially any rate because there was no 13-month guideline. Not anymore. A 13-month rate now must follow the guidelines for a 12-month rate cap. Its just another loophole being closed.