Fact: The target Fed Funds rate is up 2100% while Top short-term CD rates have risen over 1000% in the past 18 months. Loan rates react more quickly to rises in the Fed Funds rate.

U.S. banks reported a 15.5% increase (year-over-year) in the amount of credit card debt their customers are holding. The 53 banks with at least 50% growth in credit card loan balances can be found on page 5 of this week's Jumbo Rate News.

Other Resources: LLAMAS Report Bundle provides a graphical representation of a bank's loan breakdown compared to that of its peers.

Still Trying to Tame Inflation

By now you probably know, the Federal Reserve raised the Target Fed Funds rate another 25 basis points on Wednesday, July 26th. The target range is now 5.25%-5.50%, a level we haven't seen since 2001. In 2001, the target was on its way down from a high of 6.50%, where it had stood for nine months.

We cannot predict with any confidence that we are headed back up to 6.50%, but we do expect some additional tightening before the end of the year. The next scheduled meeting is September 20th, and will include projections. For now, we are a bit dumfounded at the pace at which they have risen.

In the last 18 months (January 31, 2022 through July 31, 2023) Jay Powell and the Fed’s Open Market Committee (FOMC) have risen the target Fed Funds rate 2100%. We all know very well that loan rates rise much faster than savings or CD rates when the Fed Funds rate rises. (And loan rates fall more slowly in response to a lower Fed Funds rate.)

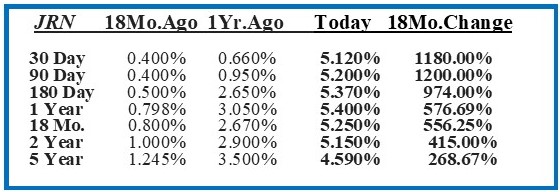

Below is a chart of the Top Jumbo CD rates from Jumbo Rate News from 18 months ago, 1 year ago and from today, along with the percent change from 18 months ago. The top short-term CD rates have risen over 1000%.

They may rise more before its done, but that 5 year rate, which is lower than all other top rates, is a clear indication that bankers believe rates will not stay this high for very long. Bankers are betting that CD rates will begin to decline in about a year.

In that year, though, loan rates will be much higher than what we have become accustomed to; we are particularly concerned about the affect on credit cards. At March 31, 2023 U.S. banks reported a 15.5% increase in the amount of credit card debt. So far, consumers are handling that debt well, but as rates continue to rise, so will past due accounts.

The 53 banks listed on page 5 each reported more than 50% growth in credit card loans in the 12 months between March 31, 2022 and March 31, 2023. Some, like 5-Star Capital One, N.A., McLean, VA, grew those loans via merger. Last October, Capital One USA merged into its affiliate, Capital One, N.A. Nearly 65% of the combined Capital One total loans are consumer loans. Of those, 61% are credit cards. We were surprised, however, to see how many other banks on page 5 actually specialize in commercial lending.

Today, with the loss of Capital One USA, only ten banks are classified by the FDIC as “credit card” banks. They are listed below (ordered by credit card growth, descending). None reported any where near the growth in credit card loans as the page 5 banks. We can assume that either: the banks listed on page 5 are lending more to consumers to diversify their loan portfolios; or, their few existing credit card customers have charged up their cards tremendously over the year.

| Cert. # | Bank Name | City | ST | Star Rating | Total Assets ($ mils) | Total Loans ($ mils) | Credit Card Loans ($ mils) | Lev. Capital Ratio | Bauer’s Adj. CR | Credit Card Growth |

| 25620 | Credit One Bank N.A. | Las Vegas | NV | 4-Stars | $1,245.341 | $774.971 | $774.971 | 47.62% | 46.30% | 33.23% |

| 57203 | Barclays Bank DE | Wilmington | DE | 4-Stars | $37,352.000 | $28,576.000 | $28,232.000 | 13.00% | 12.13% | 30.54% |

| 4091 | Stride Bank N.A. | Enid | OK | 5-Stars | $3,350.310 | $2,204.239 | $1,383.879 | 7.05% | 6.60% | 26.85% |

| 5649 | Discover Bank | Greenwood | DE | 5-Stars | $130,702.905 | $112,668.824 | $89,596.544 | 10.03% | 8.99% | 21.71% |

| 27471 | American Express NB | Sandy | UT | 5-Stars | $165,450.140 | $128,877.893 | $84,973.059 | 9.28% | 8.89% | 17.45% |

| 27314 | Synchrony Bank | Draper | UT | 5-Stars | $99,374.000 | $86,128.000 | $81,114.000 | 12.18% | 10.67% | 12.26% |

| 57570 | Comenity Capital Bk | Draper | UT | 3½-Stars | $11,913.520 | $10,239.971 | $9,912.262 | 16.39% | 13.82% | 11.42% |

| 34519 | Merrick Bank | South Jordan | UT | 3½-Stars | $5,822.641 | $4,659.430 | $3,747.465 | 20.44% | 16.91% | 10.78% |

| 27499 | Comenity Bank | Wilmington | DE | 3½-Stars | $8,551.192 | $7,519.512 | $7,519.512 | 15.71% | 12.92% | 0.20% |

| 34535 | TCM Bank N.A. | Tampa | FL | 4-Stars | $315.307 | $284.043 | $186.633 | 19.64% | 19.11% | -0.88% |

5-Star Starion Bank, Bismarck, ND, for example, has a commercial lending specialization. Yet, it increased its credit card loans over 3000% during the 12 month period. A year ago, Starion Bank had just $7,000 in credit card loans on its books. This March 31st, it reported $277,000. That’s growth of 3857%, but it still represents less than 1% of total loans. Fortunately, the quality of Starion’s loan portfolio is very good.

At 0.2%, Starion Bank’s delinquency to asset ratio is better than its peers. And with a Bauer’s Adjusted Capital Ratio of 9.57%, just 20 basis points lower than its 9.77% leverage capital ratio, there is no need to worry about Starion Bank’s loan underwriting. The same is true for the other banks listed on page 5. But we will still have our collective eyes on them… just in case.