You've likely already heard or read about the proposed acquisition of Discover Bank by Capital One. What you may not realize is how this combination would change the credit card landscape.

If approved, three big banks would hold more than 50% of all bank credit card loans.

It also gives American consumers fewer options in a market that is already tightly held.

What a Capital One-Discover Combo Looks Like

While we were enjoying the three-day weekend that Presidents’ Day affords us, Capital One Financial made a $35.3 billion offer to buy Discover Financial Services. If approved, this combination would create the nation’s largest credit card bank with over $610 billion in assets and more than $225 billion in outstanding credit card loans.

That’s a big IF, though. You may recall a pending acquisition of 5-Star First Horizon Bank, Memphis, TN by 5-Star TD Bank NA, Wilmington, DE was jettisoned last May after failing to secure regulatory approval.

We could be looking at a similar situation here.

With $82.536 billion in assets, First Horizon Corporation is the 38th largest U.S. bank holding company. It is also the oldest bank in the Volunteer State, although its branch network of 427 extends far beyond the Tennessee borders (JRN 40:04).

TD Group US Holdings LLC is the tenth largest U.S. bank holding company with $511.770 billion in assets, but falls under the larger umbrella of The Toronto Dominion Bank, out of Canada.

TD Bank operates through nearly 1,200 branches in the U.S. and while the majority are headquartered in the northeast, there is significant overlap with First Horizon in both Florida and South Carolina. A foreign acquirer and those overlapping branches gave this transaction two strikes from the start.

A 2020 order from the Consumer Financial Protection Bureau (CFPB) against TD for deceptively charging overdraft and a range of other fees, compounded with a 2022 report that alleged systemic fraud and abuse, brought with them the third strike as they spawned the ire of both regulators and lawmakers.

One lawmaker in particular, Senator Elizabeth Warren (D-MA) called on regulators to block this and all TD acquisitions until it changed its behavior. Ms. Warren has also asked regulators to block the Capital One-Discover deal saying it,

“threatens our financial stability, reduces competition, and would increase fees and credit costs for American families."

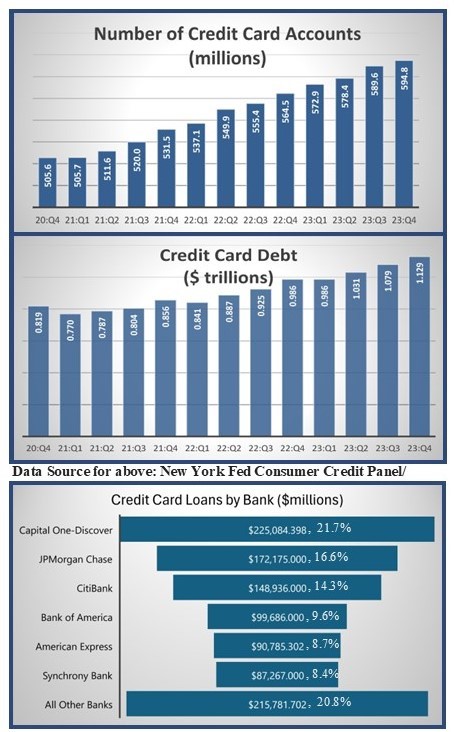

That may be true. With over $225 billion in credit card loans outstanding, a combined Capital One-Discover Bank would hold roughly 20% of that debt. For comparison purposes, JPMorgan Chase Bank holds about 16% and Citibank holds another 14%. Those are currently the two banks with the most credit card loans on the books. If the Capital One-Discover deal goes through, these three banks—Chase, Citi and Capital One—will hold over half of all credit card debt in the U.S.

Overlapping branches is a nonissue because Discover is essentially a branchless bank. A foreign acquirer is another nonissue in the case. However, Discover Bank is operating under a consent order relating to consumer protection laws and regulations (FDIC-23–0014b 9/25/2023). Normally, this would not matter as it’s the acquirer’s track record that comes into play when looking at merger approval odds. In this case, it could actually play in Capital One’s favor. We will be interested to see how this plays out, or doesn’t, as the case may be.

In the meantime, the 50 banks listed on page 5 hold the most in credit card loans as of September 30, 2023 financial data. They are listed in descending order by credit card amount outstanding. (We highlighted the two looking to merge.)

According to the Federal Reserve Bank of New York, the number of credit card accounts has increased more than 17.5% in the past three years (from the end of 2020 to the end of 2023). The outstanding balance on those credit cards more than doubled that pace, growing 38% growth during that same timeframe.

Having fewer options in a market with such strong growth, may not be the wisest move for the American people. The combination would be a boon to Capital One, however. In the hands of Capital One, Discover’s payments network could become a fierce competitor to MasterCard and Visa.

Data Source for 3rd Graph: Bank Call Report Data as of September 30, 2023.