What a Difference a Decade Makes

As we approach the end of this year, and the end of another decade, we’d like to reflect on some of the biggest changes we’ve seen over the past ten years. Ten years ago, the combined U.S. bank and credit union industries boasted over 16,000 institutions, only about 40% of them earned Bauer’s highest (5-Star) rating. Hundreds of failures and thousands of mergers have transpired since, bringing our system of federally-insured depository institutions down to only about 10,000.

While they may lack the quantity they once had, the vast majority of today’s banks and credit unions are quite strong. There are literally thousands of high quality financial institutions in operation across the nation today. In fact, with the newest star-ratings (just released this month) there are only 66 banks and 108 credit unions relegated to Bauer’s respective Troubled and Problematic Reports. That’s less than 2% of each industry.

Contrast that to ten years ago when over 12% of the nation’s banks were rated 2-Stars or below. In fact, here are some excerpts from the final issue of JRN from 2009 (JRN 26:48): 2009 Ending on a Hope and a Prayer, dated December 21, 2009:

“2009 may go down in history as the year of wishful thinking...

If another Great Depression was on its way, it has been averted. Even so, the economy still has several heavy weights to drag as it begins its uphill climb: the housing market is still weighing heavily on consumers’ net worth; credit card debt, which rose as a means for consumers to get by, has new ‘consumer protection’ laws that increased minimum payments to the point that many more may end up in default; unemployment remains high and consumer confidence low.”

The fed funds target was at an all time low at near zero (and had been for a year already) and the top 1 year Jumbo Certificate of Deposit was just 1.83%.

Fast forward to today, a decade later: the Fed Funds Target is between 1.5% and 1.75%; the Top 1 year Jumbo Certificate of Deposit is 2.27%, unemployment is at record lows and consumer confidence has bounced back beyond anyone’s expectations ...which will make this a Happy Holiday indeed.

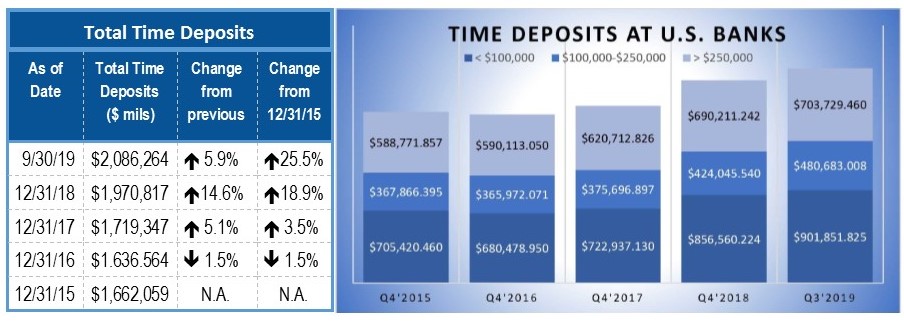

As we enter into the third decade of the millennium, bank loan demand is strong in all major categories. With increased loan demand, comes a need for more deposits. As a result, deposits in domestic bank offices increased by 1.8% in the third quarter and 5.2% in the last 12 months.

Community bank deposit growth outpaced that of noncommunity banks with an annualized third quarter deposit growth rate of 6.2%. On page 7 you will find a list of the 50 community banks with the highest dollar volume of Jumbo Certificate of Deposit liabilities (deposits) as of September 30th. You should recognize some of them from our rate pages and we’ll see if we can get some more added while they have the appetite for deposits (see chart below).