If you can’t remember the last time federal regulators denied a bank merger application, you’re not alone. It has been years. In fact, when we began writing Jumbo Rate News in 1983, there were almost 15,000 banks in the U.S.; by the turn of the century (December 31, 1999) there were 8,580; today there are fewer than 5,000.

Two-thirds of the industry gone in less than 40 years. But, last summer (July 9th to be exact), President Biden called on the Justice Department as well as bank regulators to “provide more robust scrutiny” of these mergers.

He gave them a deadline of not later than 180 days (from July 9, 2021) to adopt a new plan that would revitalize bank merger oversight. The goals are: a) ensure Americans have choices among financial institutions, and b) guard against excessive marker power.

The order went on to say that communities of color and low-income communities are disproportionately affected by the resulting branch closures. Small business lending suffers as well. Not only is small business lending lessened by an estimated 10%, lack of competition also engenders higher interest rates.

So, the question we have is, did BMO Financial (parent of the mega-bank 5-Star BMO Harris Bank, N.A., Chicago, IL) wait too long to come to an agreement to acquire 5-Star Bank of the West, San Francisco, CA? Or, will this merger get rubber stamped as a matter of course, just as hundreds have before it?

BMO Financial, whose parent is Bank of Montreal in Canada, has apparently had its eye on Bank of the West for years, but a deal was just announced on December 19th. And, it’s huge.

Already the 19th largest bank holding company in the nation, BMO Financial has $193 billion in assets. Of that, $166 billion belongs to BMO Harris Bank, making it the 24th largest U.S. bank.

Bank of the West, another foreign-owned bank, (owned by BNP Paribas, Paris, France) is the 35th largest U.S. holding company—BNP Paribas USA in New York City. The combination of these two Big Banks would propel BMO Financial into the 14th slot by size, with $343 billion in assets. That will put it behind Capital One and, perhaps more importantly, it will still remain behind its Canadian rival, TD Group (out of Toronto). With $514 billion in assets, TD Group sits comfortably at #11.

The largest bank acquisitions of 2021 are listed on page 7. If approved, this merger will not only dwarf them all, it will be one of the largest acquisitions in years. But we do have to wonder about the timing.

BMO Financial CEO, Darryl White, seems confident it will be approved. Looking at Bank of the West’s 538 and BMO Harris Bank’s 535 branch locations, we see possible overlap concerns in Arizona, Minnesota and Missouri. Of those, Arizona will most likely be scrutinized the most as it already lacks competition. Seventy-one banks currently have branches in the Grand Canyon State; only 13 call it home.

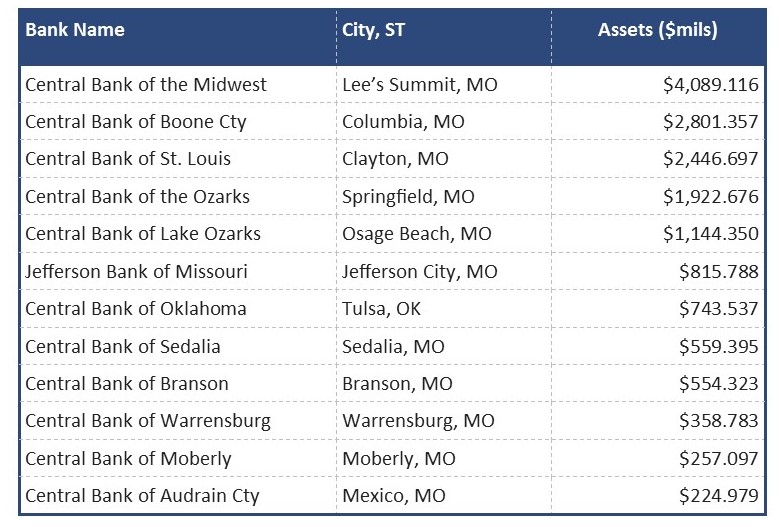

As we already mentioned, the largest 50 bank acquisitions of 2021 are listed on page 7. There are a couple things on that list worth mentioning. When Bancorpsouth Bank acquired Cadence Bank on October 29th, it also took the Cadence Bank name. And, on October 1st, Central Bancompany, Inc., Jefferson City, MO combined all of its subsidiary banks merging them all into certificate #12633 4-Star Central Trust Bank, Jefferson City, MO. This included, by asset size:

The transaction brought Central Trust Bank from $3.6 billion in assets to nearly $20 billion in one fell swoop. It also made Central Trust Bank the largest bank acquirer of 2021. Ten of its former subsidiary banks are listed on page 7.

2 comments on “Will There be a Merger Miracle in 2022?”

Comments are closed.